Cash-strapped college students need to watch every penny they have and luckily there are a lot of great new ways to do just that. This article will give you 10 tips for how to make the most of new devices, apps, and strategies that will stretch your dollar, organize your wallet, and plan your finances. With the latest technology available, it's quick and easy to set yourself up to monitor your spending on a daily basis. Here are some recommendations:

1) Make the Most of Rewards Cards

Students who are savvy about rewards will end up getting back for every dollar that they give out. Before doling out hundreds of dollars on textbooks at the start of the semester, pay attention to how you're paying for them. If you pay with a rewards credit card you could receive airline miles in return that might help fund your spring break getaway, other credit cards offer cash back for certain types of purchases. Check out annual review lists such as the NerdWallet's Best Rewards Credit Cards, Spring 2014.

Aside from credit cards, there are also loyalty programs available for nearly every retailer and many restaurants, nail salons, etc. Ask about rewards programs at stores, coffee shops, and restaurants that you frequent so you can cash in on some of the benefits of being a regular.

2) Use One Card to Rule Them All!

Organize your wallet and your life by combining all of those rewards cards onto one device – an actual credit card that holds multiple credit, loyalty, membership, and gift cards in one. You can scroll through your stored cards, click the button, and swipe away for any purchase. Right now there are two contenders in this space. Coin and Wallaby. You can sign up to take part in Wallaby's beta program, or pre-order a Coin card for $50 -half the price they'll be charging when they officially launch. Coin cards will ship this summer.

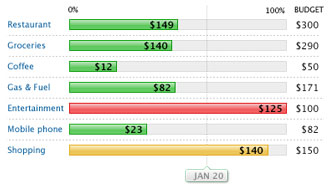

3) Use Mint for Budgeting and Notifications

Mint is a free application that lets your view all of your financial accounts into one place. Set a budget, track your goals and make your money go further. You can also take Mint with you on your phone, tablet, or any mobile device so that you can keep track of your spending at all times. Mint will also send you notifications of activity in your accounts such as low balance alerts, bill payment reminders, etc. What I really appreciate about Mint is all of the colorful graphs and pie charts it provides to give you an idea of how you're spending your money at a glance.

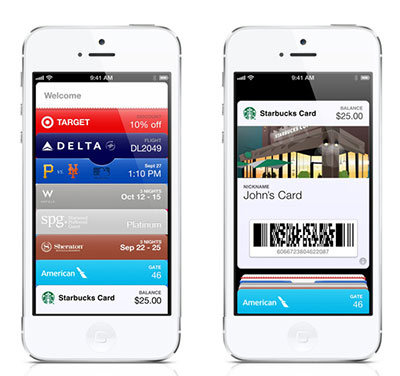

4) Put Your Wallet on Your Phone

New mobile wallets enable smartphone owners to store coupons, boarding passes, event tickets, store cards, ‘generic' cards, and other forms of mobile payment in their cell phones. Apple's iOS Passbook stores and displays a variety of 2D barcodes such as QR codes, each of which is considered a "pass" that can be used for boarding most major airlines, as a mobile movie ticket, or to pay at Starbucks, Subway, Walgreens, Sephora, and many more retailers. The Square Wallet app also works with Starbucks and a variety of other merchants, as does the Google Wallet. Why not organize all of these into the one place that's most convenient and always at hand – your phone?!

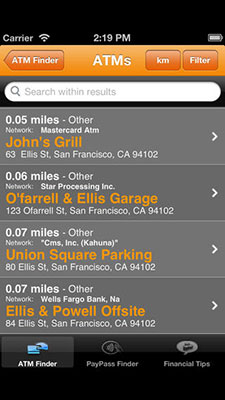

5) Use Handy Budget Apps

- ATM Hunter to Avoid Fees – Locate the closest ATMs with this handy app. You can specify which banking networks to search for to avoid fees or only search for your own bank.

- Scoutmob For Your Next Meal – Scoutmob is a local, budget-friendly app that helps you find real-time deals on restaurants, retailers, and events. Once you have the app it will alert you whenever you walk into a restaurant with a dining discount or a store with a coupon.

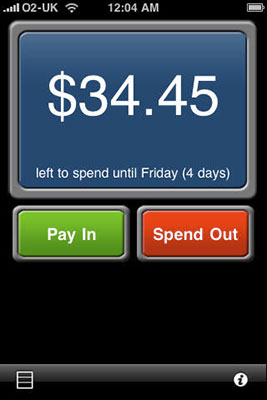

- Cash-Strapped for Controlled Spending – Set a daily, weekly or monthly budget for all your disposable income and keep track of it with Cash-Strapped. Each time you spend money at Starbucks, buy a slice of pizza, or go out to the movies, simply enter the amount and your remaining budget will be recalculated immediately.

6) Ask for Student Discounts

Budget-conscious students carry their student IDs with them everywhere. You'd be surprised how many stores (TopShop and J Crew for example), movie theaters, restaurants, and museums offer special pricing for college students. Keep that ID handy so you can benefit the most from your student status!

7) Take Advantage of Amazon Student

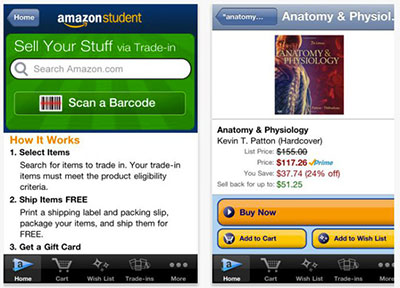

This free app lets college students scan in barcodes to compare prices of textbooks and just about anything else. But the best feature of Amazon Student is the ability to sell back textbooks and other items in exchange for Amazon gift cards…Amazon will even pay the shipping! They're also offering students the opportunity to get free two-day shipping for 6 months if they sign up for the Amazon Student program.

8) Monitor Groupon and Living Social Daily

Find out what the best and most exciting things to do are in your campus neighborhood and then save anywhere from 50% – 90% through Groupon and LivingSocial deals. Both of these online sites provide the best local deals and discounts on restaurants, events, entertainment, and travel. Budget savvy students will monitor these sites on a daily basis.

9) Rent your textbooks!

Why buy when you can rent? Especially when it's a textbook you'll only be using for a matter of months. Check out textbook rental websites such as Chegg and Amazon and search for your textbook list there. Some companies even offer free shipping for when you're returning books!

10) Follow Budget Tips on Pinterest Boards

The Pinterest online bulletin board site has many boards that offer money tips and budget advice such as this Budgeting|Money Tips board with pins ranging from tips to save on online orders to 5 surefire ways to get your budget back on track. And here's another budget board with nearly 2,000 followers! Simply searching on Pinterest for budget will return you many others.

Good luck and happy budgeting!!